Fuel Programs

Fuel Programs

Let Us Help You

Single Point Capital offers fuel credit lines to keep your trucks moving. Our fuel credit program provides up to $1500 per truck, per week, and is available exclusively to Single Point Capital’s freight factoring clients.

How Our Fuel Credit Lines Work

We structure our lines of credit around the total amount of revenue generated by our clients each month. Single Point Capital’s internal credit rating system calculates the amount of fuel credit that each client receives. The invoices received from existing factoring clients are leveraged to create a fuel credit line which the drivers can use at a wide range of nationwide truck stops. Our fuel credit lines feature:

• Fuel credit lines of up to 20% of your monthly revenue volume

• Credit grows with your fleet

• Low interest rates

• Mobile apps to manage your fuel account

• Fuel card can be used wherever MasterCard® is accepted

• No fees to cardholders when MasterCard® Signature Debit is used at the point-of-sale.

Savings on Fuel and More

Our fuel program includes a mobile app that allows your drivers to find the lowest fuel prices while on the road. The app shows net prices with available discounts so truckers can fuel up, while saving money for your company.

Keeping your trucks fueled is just a small part of the savings Single Point Capital offers to clients. Our fuel card program offers a number of benefits, including:

• Acceptance at more than 7,000 fuel locations nationwide

• Discounts on tires from more than 3,000 dealers

• Discounts at the pump from thousands of truck fueling locations and diesel merchants

• Cover maintenance costs with our MasterCard® network

• App features save time at CAT Scale Weigh Stations

Single Point Makes It Easy to Manage Your Fleet’s Funds

Enrolling in our fuel program will enable you access to apps and tools that will help you to manage funds and track fleet expenses:

• Fuel discounts with real-time rates and locations

• Track transactions

• Theft detection and fraud alerts

• Management tools for payroll advances, and settlements

• Insights and reports for driver scorecards based on fuel use and expenses

Our customizable fuel program will provide savings and fuel credit lines for all your drivers, as your revenue and fleet continue to grow. The automated program will help you to accurately track expenses, enabling you to focus on running your trucking company.

Single Load Fuel Advance

Single Point Capital offers fuel advances based on the value of the hauled shipments. Our single load fuel advances are exclusive to both existing and new clients enrolled in our factoring program. Clients can receive a fuel advance up to 40% of the rate confirmation. For example, a truck hauling a shipment worth $1,000 can be provided an advance of up to $400. Single Point Capital can provide single load fuel advances to cover your fleet, according to the number of trucks listed on your company’s insurance policy. We issue new advances once the old ones are closed to keep your fleet moving, and our single load fuel advances can be used in tandem with our fuel credit line.

Premium Financing

Premium Financing

Let Us Help You

At Single Point Capital, we know that one of the biggest hurdles new trucking companies face is the down payment for insurance. The initial cost can be steep, especially when everything needs to be paid upfront. Single Point Capital simplifies insurance down payments for your business.

Clients who have signed up for factoring services from Single Point Capital can now take advantage of our deferred down payment program for insurance. We are able to defer up to 50% of your insurance down payment in three simple steps.

Step 1

Single Point works with your insurance agent to confirm coverage and your down payment amount

Step 2

Single point pays up to 50% of your down payment

Step 3

The advance is repaid from your factored invoices over a period of 6-10 weeks

Sign Up

Sign Up

Please take a couple minutes to complete the Single Point Capital Factoring sign up form below to get your no-obligation quote.

Our Story

Our Story

Who is Single Point?

We are a family owned business with a passion for helping other small businesses succeed. Our team of experts provides a complete suite of financial services, logistics, and back-office support to our customers and partners.

Our Story

Established in 2008, Single Point Capital began in the same way that many of our clients’ businesses did – with vision and determination. We set out to become a single point for the industry, providing financial services, consultative support, and back-office management. Partnering with clients in order to enable them to accelerate their cash flow and expand, Single Point supplies working capital solutions and provides the necessary support that can fuel your business to the next level. Learn more about how Single Point can help point your business in the right direction.

Our Mission

To protect and empower our clients with comprehensive financing solutions, delivered with integrity, reliability, and exceptional customer service

Blog

Resources and News

Easing Supply Chain Issues and Tax Credits for Truck Drivers

The trucking industry is currently suffering from a major driver deficit. The industry as a whole is short by nearly…

Setting Liability Limits for Trucking Companies

For years, the trucking industry has been caught between a rock and a hard place with “nuclear verdicts,” with courts…

What Does It Take to Successfully Launch a Trucking Company?

Many owner-operators are taking the leap from hauling shipments by themselves to multiplying their earning by launching…

New Trucking Companies: Finding Shipments and Dispatching

New trucking companies tend to work locally, but there is an ebb and flow to demand. Sometimes it can seem like feast…

Insurance Company Rates Drive Across All Lanes with Trucking Industry

The American Transportation Research Institute reported that insurance premiums for trucking companies increased on…

Will the Trucking Industry See the Federal Excise Tax Repealed?

For years, there have been initiatives to move the trucking industry away from fossil fuels and find ways to reduce the…

Stop B2B Cash Flow Slowdowns

In the B2B arena, cash flow slowdowns are becoming more prevalent. Last year the private and public sectors combined…

Starting Your Own Trucking Company: The Biggest Expenses

Starting a trucking company is profitable, and helps improve currently strained supply chains. Whether you want to…

Insurance Rate Hikes Target the Trucking Industry

Insurance rates have been climbing over the past few years, with no sign of slowing down. In a recent study by…

How to Lower Insurance Costs for Your Trucking Company

Insurance rates for trucking companies have been on the rise, and providers have been warning internally that they…

2023 Could Be the Year of Women in Trucking

Despite the driver shortage – or maybe in spite of it – women are starting careers in the trucking industry at record…

The Electric Switch Poses a Major Challenge for the Trucking Industry

2030 may seem like a long way off, but the initiative rolled out in 2022 for the trucking industry to switch to…

Dispelling Myths About Trucking and the Economy

While mainstream news outlets keep posting headlines about a possible recession, the struggle of small businesses,…

Maximizing Cash Flow Ahead of the Fourth Quarter

Businesses are now ramping up for the busiest time of the year. Carriers are going to be hauling shipments for school,…

Falling Fuel Prices Open Opportunities for the Trucking Industry

Last month, after reaching record prices of over $5 per gallon, fuel prices throughout most of the United States began…

Innovative Ways to Recruit and Retain New Truckers

Demand in the trucking industry is still growing, yet the driver shortage is also increasing. One of the biggest…

AB5 Takes the Spotlight for the Trucking Industry

California Assembly Bill 5, the legislation that is aimed at providing more benefits to those who work in the “gig…

Automating Accounts Receivable for Your Business

Businesses of every size and type are looking for ways to automate operations to save money and resources. One of the…

Spot Rates, Contract Rates, and the Future of Trucking

Last quarter, spot rates plummeted drastically, forcing carriers to shift their priorities to contract shipments to…

Diesel Fuel Prices Reach a Tipping Point

At the start of 2022, fuel prices were on the rise due to a combination of inflation, product scarcity, slowed…

ATRI Releases Priorities for the Trucking Industry in 2022

The American Transportation Research Institute (ATRI) has identified its top priorities for the trucking industry. The…

Announcing the New Single Point App

Single Point Capital is proud to announce our new mobile app, which provides users with everything they need from news…

Factor Your Invoices and Stop Playing the Waiting Game

On paper, running a business seems simple. Businesses sell a product or service, issue invoices, and then the customer…

Automated Vehicles Could Give Small Trucking Companies an Advantage

At the start of the second quarter this year, Fortune published an article on how automated vehicles could comprise up…

The Difference Between Reactive and Proactive Trucking Companies

The trucking industry has been through a lot over the past few months, if not the past few years. While trends can…

Solutions

Services

What Do We Do?

Single Point Carrier Services is a multifaceted company that provides a complete suite of financial services, logistics, and back-office support to our customers and partners.

Factoring

Logistics

Fuel Programs

Dispatching

Insurance

Start-up Program

Referral Program

Referral Program

How the Referral Program Works

We offer highly competitive monthly commissions or cash payment for every new client that you refer to us. Single Point Capital believes in fostering long-term relationships with our referral partners by consistently providing the highest level of service.

Referral Program Benefits:

• Quick and simple referral process

• Absolutely no cost or obligation to you

• Earn residual commission on all new clients for the life of the deal

• Monthly commission reports for full transparency

• We refer business back to our partners

Factoring

Freight Factoring

Invoice Factoring

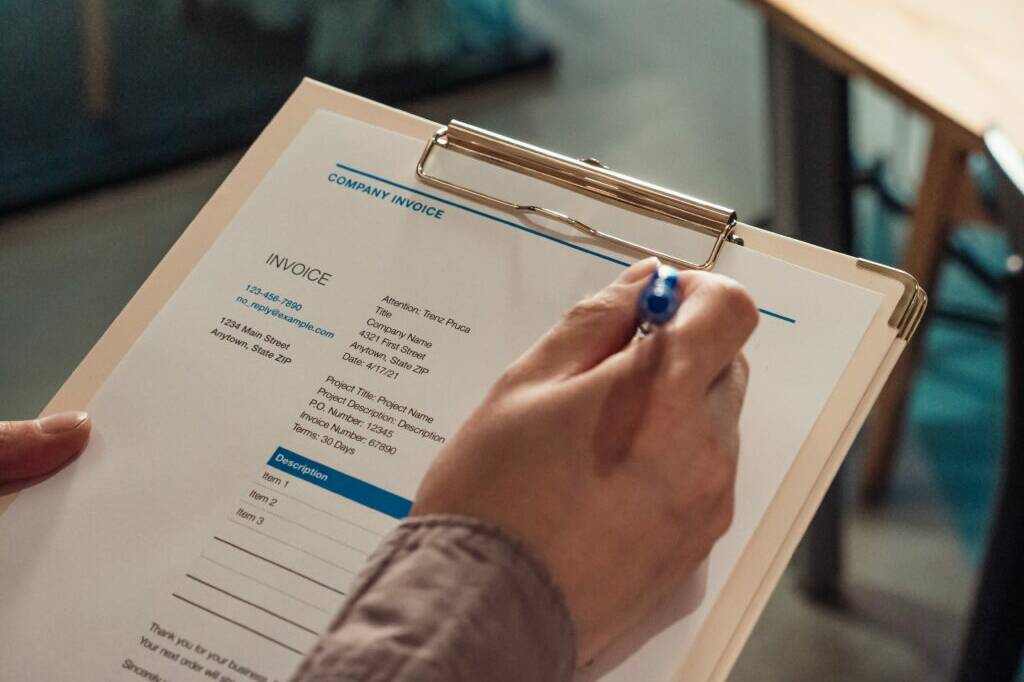

Single Point Capital provides same-day invoice factoring solutions to help increase cash flow, allowing you to focus on your company’s growth.

How It Works

How Can Factoring Help Cash Flow?

Your trucking business is getting plenty of loads but waiting 30, 60 or 90 days to get paid is slowing you down. Single Point Capital can pay you immediately for those invoices, allowing you to grow your base more rapidly.

Single Point provides immediate assistance

Sign up for free today! We’ll get you approved right away – and you’ll immediately be able to start submitting your invoices to our system.

Convenient Mobile and Desktop App

Submit loads and paperwork easily in our mobile and desktop apps.

Manage your business efficiently with the Single Point App. You can submit load paperwork for funding, quickly check your customer’s credit or access your account management portal easily through our mobile or desktop app.

Free Customer Credit Checks

Upon approval, you’ll be able to access valuable information about freight brokers who may pay slowly or not at all, keeping them accountable. Making informed decisions about what loads you take will allow your business to run more smoothly.

Keep Your Focus on the Road Ahead

When you start submitting your invoices to us, you’ll be freed up to focus your energy on what you really want to do: find loads and get them from Point A to Point B. We will process your invoices the same day, so you can keep doing what you do best.

Get Paid the Same Day!

As soon as your funding packages and supporting documents are verified, you’ll start receiving same-day payments in the way that is most convenient for you: ACH, wire transfer, or another established method of your choice.

Pricing

How does our pricing work?

Simple. We charge a small flat fee and bill your customers for you and take care of the collection process.

How much will factoring save you?

Factoring is one of the most cost-effective solutions for your trucking business.

Factoring with Single Point Capital allows you to get your money faster so that your business can experience consistent growth, but that’s not all! Our factoring services are bundled with comprehensive back-office support including:

• Free credit checks

• Access to our free load board

• Dedicated account manager

• Billing, invoicing, and collections

• Accounts receivable tracking software

• Access to fuel advances and line of credits

Your partnership with Single Point Capital entitles you to many exclusive perks not offered elsewhere.

Discover how it feels to have a personal account executive, customized just for you.

Our services include invoicing your customers, processing collections and payments, and providing full back-office support. Before you take on a load, we run free online credit checks, and with Single Point Logistics, you’ll command higher freight rates and be eligible for fuel and insurance discounts.

We do everything but make your coffee!

Transparent Pricing

Our pre-agreed rates are customized to ensure you’ll receive the lowest, most competitive rate available, which varies depending upon your customers and purchase volume.

Factoring FAQs

Find answers to our most frequently asked questions here. If you have additional inquiries regarding our services, please submit this form and we'll reply within 72 hours.

Simply complete your online application here and a Single Point representative will reach out to provide you with a customized quote for your business. No personal credit checks and no application fees.

We know every business is unique, so we build personalized plans around your company’s needs.

Our clients have 24/7 access to free online credit checks through the single point mobile app. Simply Login to see if your customer is approved. Our team is always available to provide guidance with tough credit decisions. You can receive a credit check via our mobile app.

Yes, we do offer fuel advances, contingent on the customer and the specific load. Contact our representatives to determine whether your business qualifies for fuel advances.

Single Point offers same day funding upon receipt of your completed funding package. You’ll be paid by ACH, Wire, Comdata, FleetOne, or another funding source that best suits the particular needs of your business.

Single Point does not require originals unless your customer requests them; we will fund off electronic copies. To ensure that a clear copy is on file should it be needed, many customers do send us their originals on a weekly basis.

You can factor for as many or as few customers as you choose. Your Single Point Representative will be happy to discuss the details with you, regarding your customers for whom you are planning to factor.

Single Point offers you 24/7 online access to your account. You can track invoices and collections, search debtors, and pull custom reports, all of which will help you remotely manage your business from any location.

You will be assigned a Single Point Personal Account Executive, who will walk you through the factoring process step-by-step. You’ll be provided with professional, personalized service to ensure the best care for your business.

Yes. As soon as we receive your freight bills, we take care of the rest! Our role is to ensure that your invoices are properly billed and collected on time. You’ll have the ability to track your collections activity and verify due dates online at any time.

Single Point Capital

Invoice Factoring

Single Point Capital provides same-day invoice factoring solutions to help increase cash flow, enabling you to focus on your company's growth.

Our Story

Established in 2008, Single Point Capital began in the same way that many of our clients' businesses did - with vision and determination. We set out to be a single point of service for the industry, providing financial services, consultative support, and back-office management.

Our Advantages

Single Point is the leading provider of working capital solutions. We strive to deliver the best possible experience by focusing on innovation, integrity, and transparency. Our objective is to help your business accelerate cash flow, increase expansion, and provide support to fuel your business to the next level. Learn how Single Point can help point your business in the right direction.

"I have been a client of Single Point Capital for 5 years now. They have by far been able to meet my expectations and help me resolve problems when they have arrived. They are crystal clear on rates and charges which for carriers this is a must!"

"Every time I call with an issue, Single Point answers and handles the issue promptly and properly. Thank you for making my financial goals possible."

"I have used Single Point since 2012. They are by far the easiest factoring company to work with HANDS DOWN! I would not still be in business without their dedication. Thank you Single Point Capital!"

"I have been working with Single Point Capital since 2016, and I am very happy with them, I will not change Recommended!!!! they are really honest people, they always help you to solve any inconvenience."

Resources & News

Operating Costs in April 2024: Trends and Considerations

As April 2024 unfolds, the trucking industry finds itself amidst a landscape of evolving challenges and opportunities.…

Riding High: The Thriving Trucking Industry in Texas

Texas, the Lone Star State, is not just known for its vast expanses and rugged landscapes; it's also home to one of…

The Driving Force: A Deep Dive into the Trucking Industry in the Southern United States

In the sprawling landscape of the southern United States, where magnolias bloom and hospitality is as warm as the sun,…